Best Broker For Forex Trading Fundamentals Explained

Table of ContentsSome Ideas on Best Broker For Forex Trading You Should KnowThe Best Broker For Forex Trading DiariesNot known Factual Statements About Best Broker For Forex Trading Examine This Report on Best Broker For Forex TradingNot known Details About Best Broker For Forex Trading

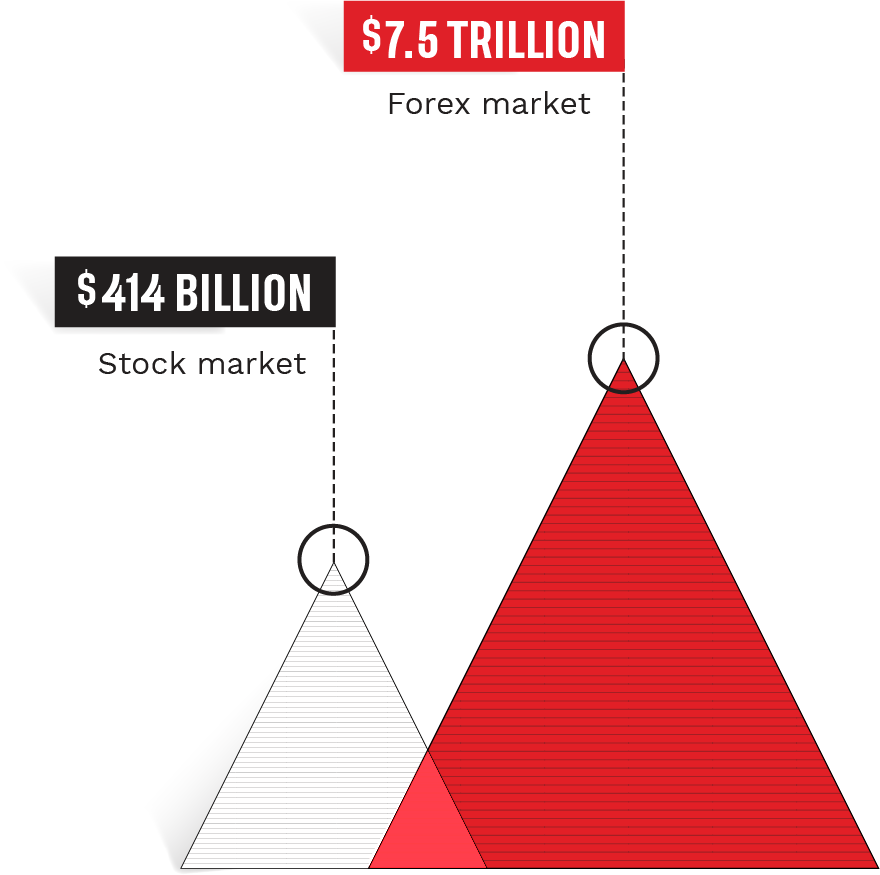

Considering that Forex markets have such a big spread and are utilized by a massive variety of individuals, they offer high liquidity on the other hand with other markets. The Forex trading market is frequently operating, and thanks to modern technology, is obtainable from anywhere. Therefore, liquidity refers to the reality that any person can purchase or market with a straightforward click of a button.Therefore, there is constantly a prospective seller waiting to acquire or sell making Forex a fluid market. Rate volatility is just one of one of the most crucial elements that help decide on the next trading action. For short-term Foreign exchange investors, price volatility is vital, considering that it shows the per hour modifications in a property's worth.

For long-term investors when they trade Foreign exchange, the rate volatility of the market is likewise fundamental. This is why they think about a "purchase and hold" approach may offer greater earnings after a long period. One more considerable benefit of Forex is hedging that can be put on your trading account. This is an efficient technique that assists either remove or decrease their threat of losses.

A Biased View of Best Broker For Forex Trading

Depending upon the time and initiative, investors can be split into groups according to their trading design. A few of them are the following: Foreign exchange trading can be successfully used in any of the strategies over. Due to the Foreign exchange market's wonderful volume and its high liquidity, it's feasible to enter or leave the market any time.

Forex trading is a decentralized technology that operates with no central management. A foreign Forex broker should abide with the criteria that are defined by the Forex regulatory authority.

Thus, all the transactions can be made from anywhere, and since it is open 24-hour a day, it can additionally be done at any moment of the day. If a capitalist is situated in Europe, he can trade throughout North America hours and check you can try this out the actions of the one currency he is interested in.

The Buzz on Best Broker For Forex Trading

A lot of Foreign exchange brokers can offer an extremely reduced spread and minimize or also remove the trader's costs. Investors that pick the Foreign exchange market can enhance their revenue by preventing fees from exchanges, deposits, and various other trading activities which have added retail purchase expenses in the supply market.

It offers the choice to go into the market with a tiny budget plan and profession with high-value money. Some traders might not accomplish the needs of high leverage at the end of the deal.

Foreign exchange trading might have trading terms to safeguard the market individuals, yet there is the danger that somebody might not respect the agreed contract. The Foreign exchange market functions 24 hours without quiting.

When retail investors refer to cost volatility in Forex, they indicate exactly how huge the increases and drop-offs of a money set are for a particular period. The larger those ups and downs are, the greater the price volatility - Best Broker For Forex Trading. Those big adjustments can stimulate a sense of uncertainty, and occasionally traders consider them as an opportunity for high revenues.

The Only Guide to Best Broker For Forex Trading

Several of the most unstable currency pairs are taken have a peek at this site into consideration to be the following: The Foreign exchange market uses a great deal of advantages to any type of Forex trader. As soon as having actually determined to trade on fx, both experienced and newbies require to define their monetary approach and get knowledgeable about the conditions.

The material of this article reflects the author's opinion and does not necessarily mirror the main placement of LiteFinance broker. The product released on this web page is offered informative purposes only and ought to not be thought about he said as the provision of financial investment advice for the objectives of Directive 2014/65/EU. According to copyright legislation, this write-up is considered copyright, which includes a prohibition on copying and distributing it without permission.

If your company works globally, it's vital to understand how the worth of the united state dollar, about other currencies, can substantially influence the price of goods for united state importers and merchants.

The Main Principles Of Best Broker For Forex Trading

In the very early 19th century, money exchange was a major part of the procedures of Alex. Brown & Sons, the first investment bank in the USA. The Bretton Woods Arrangement in 1944 needed money to be pegged to the US dollar, which remained in turn fixed to the price of gold.